Syrma SGS Technology Limited

Please refer to important disclosures at the end of this report

1

SSTL, founded in 2004, is a technology-focused engineering and design

company engaged in turnkey electronics manufacturing services (“EMS”),

specializing in precision manufacturing for diverse end-use industries,

including industrial appliances, automotive, healthcare, consumer products

and IT industries. It is one of the fastest growing companies amongst its peers.

Its manufacturing infrastructure enables SSTL to undertake a high mix of

products with flexible production volume requirements. SSTL is Leader in high

mix low volume product management and are present in most industrial

verticals. It is one of leading PCBA manufacturers in India, supplying to various

OEMs and assemblers in the market also amongst the top key global

manufacturers of custom RFID tags

Positives: (a) Established relationships with marquee customers across various

countries (b) Consistent track record of financial performance (c) Diverse and

continuously evolving product portfolio catering to various industries (d) Vertically

Integrated Manufacturing process increases cost efficiencies

Investment concerns: (a) Lack of long-term contracts with customers (b) Highly

competitive industry (c) High dependence on imports for its raw materials.

Outlook & Valuation: In terms of valuations, the post-issue P/E works out to

66.8x FY22 EPS (at the upper end of the issue price band). Company’s

consolidated PAT CAGR of ~15% over FY20-22 on back of acquisition. However,

on standalone basis the numbers are not impressive. SSTL has diverse product

portfolio, but we believe that these positives are captured in the valuations

commanded by the company. Thus, we have a NEUTRAL rating on the issue.

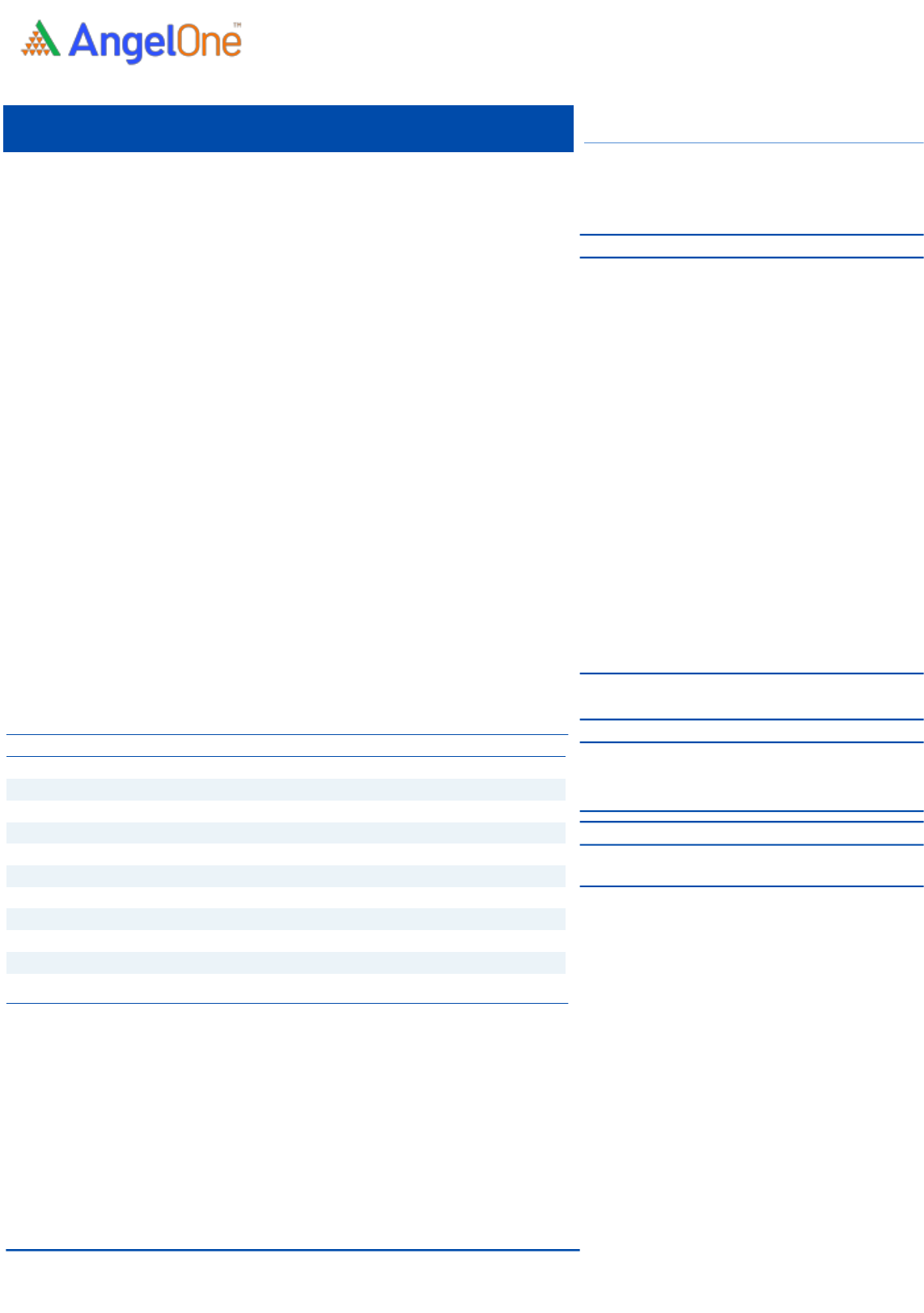

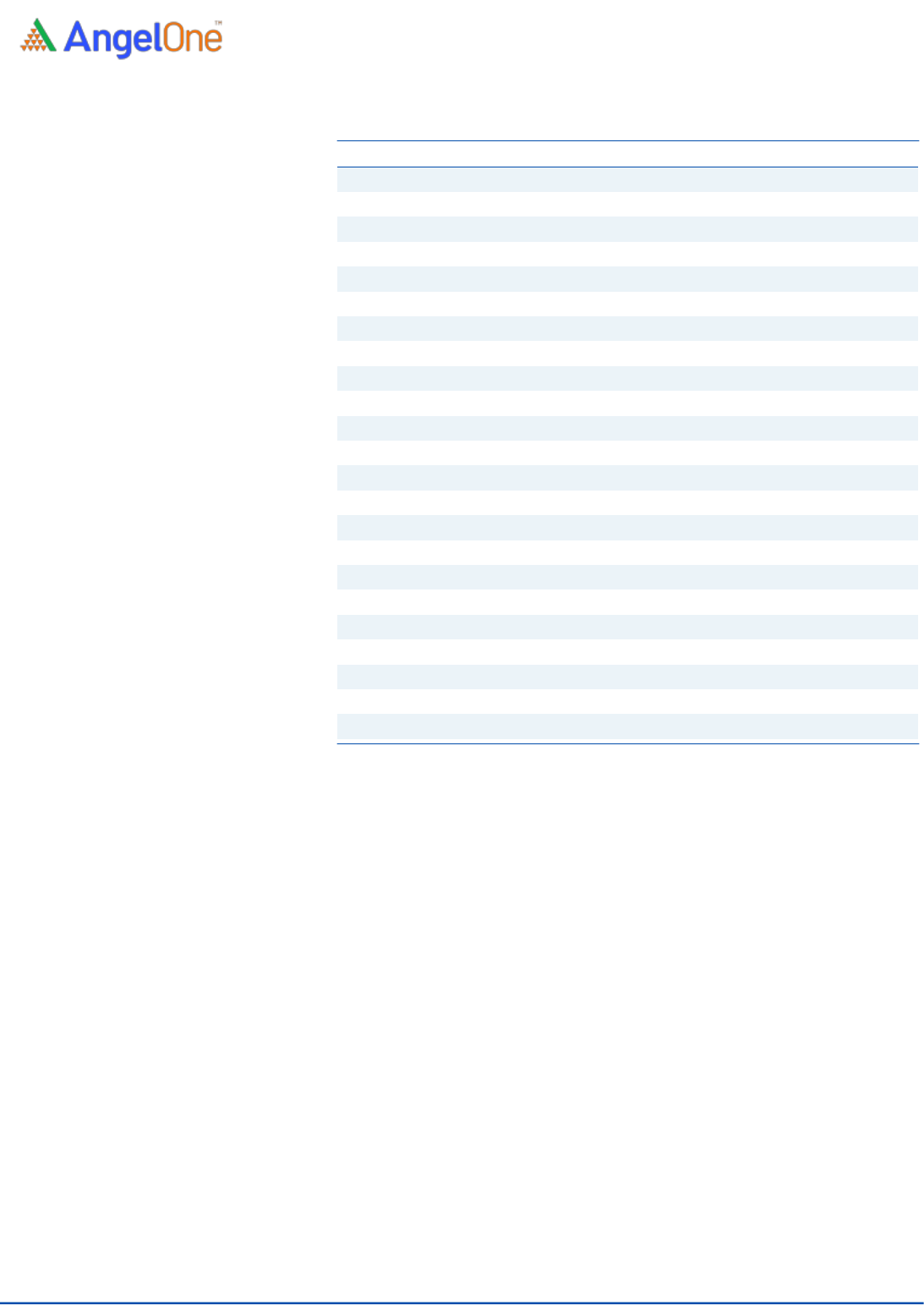

Key Financials

Y/E March (₹ cr)

FY'21

FY'22

Net Sales

438.0

1020

% chg

-

133

Net Profit

32

57

% chg

-

77

EBITDA (%)

10.7

9.3

EPS (Rs)

2.8

5.0

P/E (x)

78.3

44.2

P/BV (x)

10.4

4.3

ROE (%)

11.8

9.5

ROCE (%)

11.4

9.5

EV/Sales

5.6

2.6

Source: Company RHP, Angel Research

NEUTRAL

Issue Open: August 12, 2022

Issue Close: August 18, 2022

Offer for Sale: ` 74cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 47.4%

Public 52.6%

Fresh issue: `766cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: ` 138cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: ` 172.4cr

Issue size (amount): ₹ 840cr

Price Band: ₹209- ₹220

Lot Size: 68 shares and in multiple thereafter

Post-issue mkt. cap: * `3,722cr - ** `3,877cr

Promoters holding Pre-Issue: 61.47%

Promoters holding Post-Issue: 47.42%

*Calculated on lower price band

** Calculated on upper price band

Book Building

IPO NOTE

Syrma SGS Technology Limited

August 10, 2022

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

2

Company background

SSTL is technology-focused engineering and design company engaged in

turnkey electronics manufacturing services (“EMS”), specializing in precision

manufacturing for diverse end-use industries, including industrial appliances,

automotive, healthcare, consumer products and IT industries. It is amongst the

fastest growing. The Company has a track record of technical innovation which

involves working with the engineering teams of our marquee customers, and

over the years, company has evolved to provide integrated services and

solutions to OEMs, from the initial product concept stage to volume production

through concept co-creation and product realization. Its manufacturing

infrastructure enables it to undertake a high mix of products with flexible

production volume requirements. SSTL is leader in high mix low volume

product management and is present in most industrial verticals. Further, SSTL

is one of the leading PCBA manufacturers in India, supplying to various OEMs

and assemblers in the market. The Company is also amongst the top key global

manufacturers of custom RFID tags

Product Portfolio:

1) Printed circuit board assemblies (“PCBA”): The PCBAs are used in

products manufactured in the automotive, medical, industrial, IT and

consumer products industries, and shall include box-build products.

2) Radio frequency identification (“RFID”): The RFID products are used in

products manufactured in the shipping, healthcare, manufacturing, retail

and fintech industries.

3) Electromagnetic and electromechanical parts, which include magnetic

products like chokes, inductors, agnetic filters, transformer as well as high

volume manufacturing assemblies: The electromagnetic and

electromechanical parts are used in products manufactured in the

automotive, industrial appliances, consumer appliances and healthcare

industries, among others.

4) Other products, which include motherboards, DRAM modules, solid state

drives, USB drives and other memory products.

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

3

Issue details

The IPO is made up of Fresh issue of ₹766cr and offer for sale of 3,369,360 equity

shares aggregate up to ₹74cr making the total Issue size of ₹840cr.

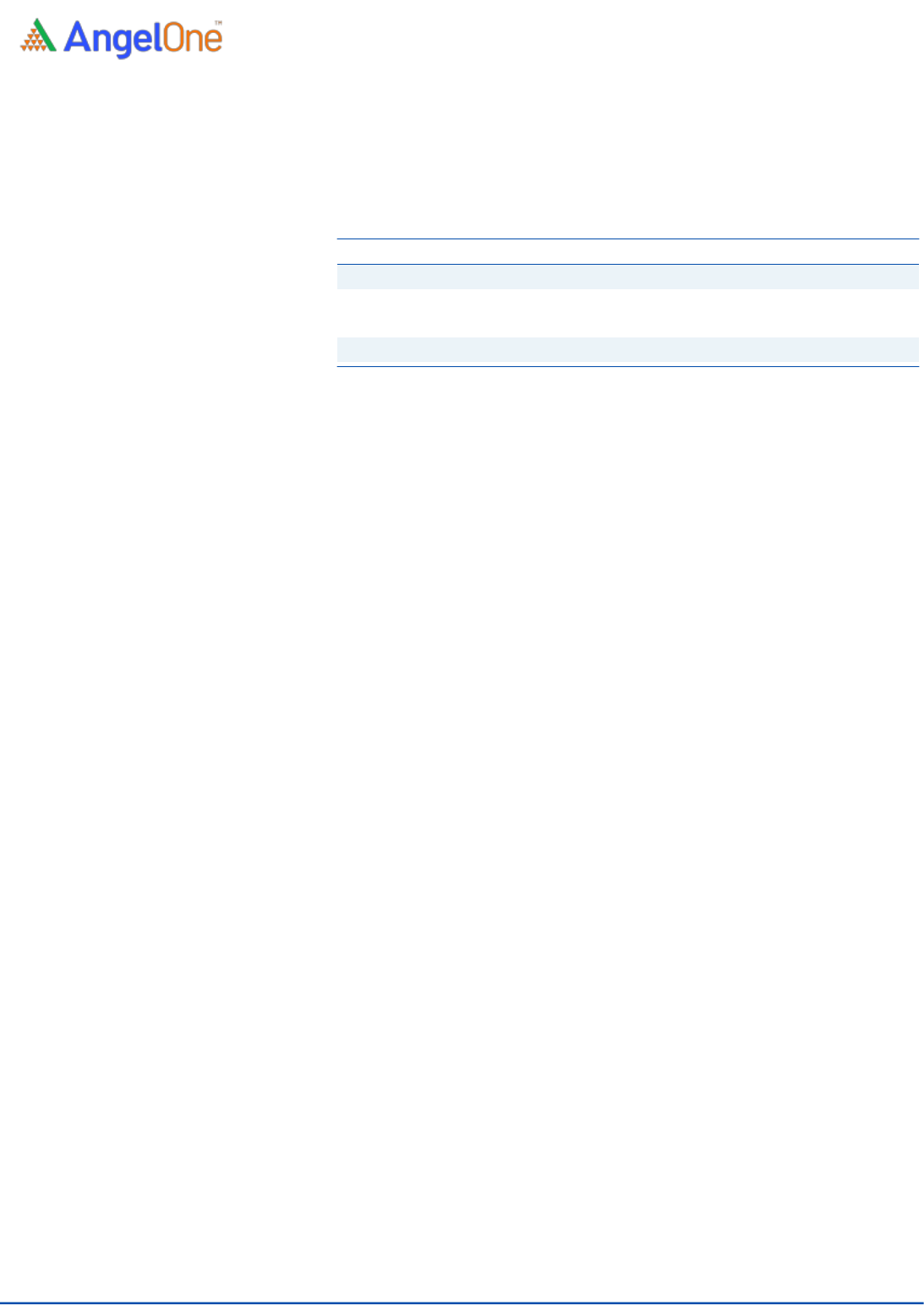

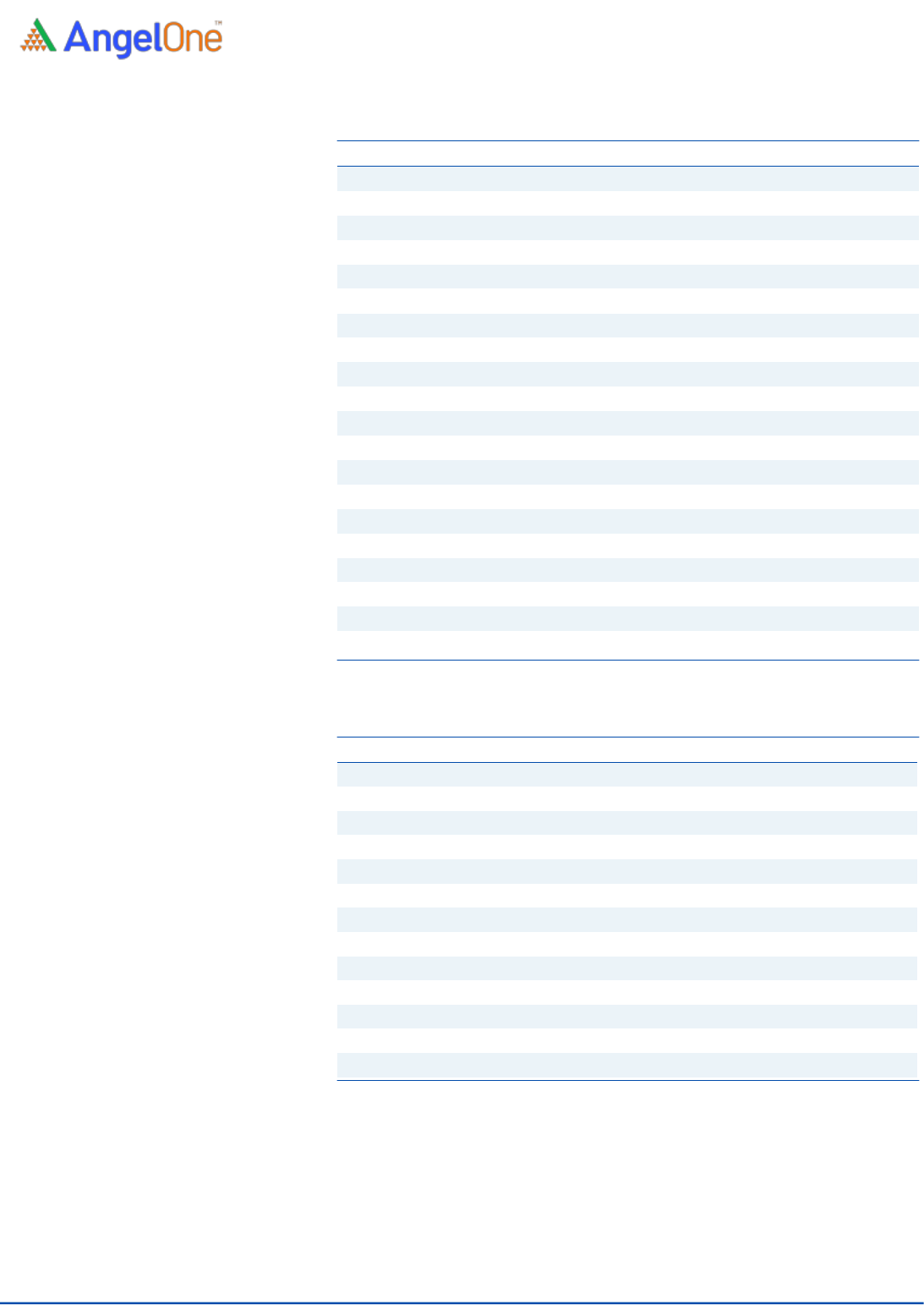

Pre & Post Shareholding

(Pre-Issue)

(Post-Issue)

Particulars

No of shares

%

No of shares

%

Promoter

8,69,31,545

61.47

8,35,62,185

47.42

Public

5,44,79,411

38.53

9,26,66,953

52.58

Total

14,14,10,956

100.00

17,62,29,138

100.00

Source: Company, Angel Research

Objectives of the Offer

◼ To carry out the Offer for Sale of 3,369,360 equity shares aggregate upto

₹74cr.

◼ Rs 766cr proceeds from the fresh issue would be utilized as follows:

o Rs 403cr for capital expenditure and expansion

o Rs 131.58cr for working capital requirements

o Rest for General corporate purposes

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

4

Key Management Personnel

Sandeep Tandon is one of the Promoter and the Executive Chairman of the

company. He has approximately 18 years of experience in the electronics

manufacturing sector. He has previously been associated with Celetronix Inc., USA

Jasbir Singh Gujral is one of the Promoter and the Managing Director of the

company. He is a director of SGS Tekniks Manufacturing Pvt Ltd

Sreeram Srinivasan is the chief executive officer of our Company. He was formally

appointed as the chief executive office of our Company on November 29, 2021. He

oversees the business operations and strategy functions of our Company. He holds

a Bachelor of Technology in metallurgical engineering from Indian Institute of

Technology, Madras, a Master of Science from North Carolina State University and

a Doctor of Philosophy from North Carolina State University. He has over 20 years

of experience in business operations. He has previously served as the vice president

(operations) of Rane Engine Valves Limited, the president & executive director of

Shanti Gears Limited, the managing director of Saint Gobain, Sekurit India Limited

and the chief executive officer of MTAR Technologies Private Limited.

Bijay Kumar Agrawal is the chief financial officer of our Company. He handles the

financial operations of our Company. He holds a master’s degree in business

administration. He has approximately 16 years of experience in finance and

business strategy. Before his association with our Company, he has previously been

associated with Motorola India Private Limited (through Manpower Services India

Private Limited), Times Internet Limited, Dalmia Bharat Limited and Omax Autos

Limited.

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

5

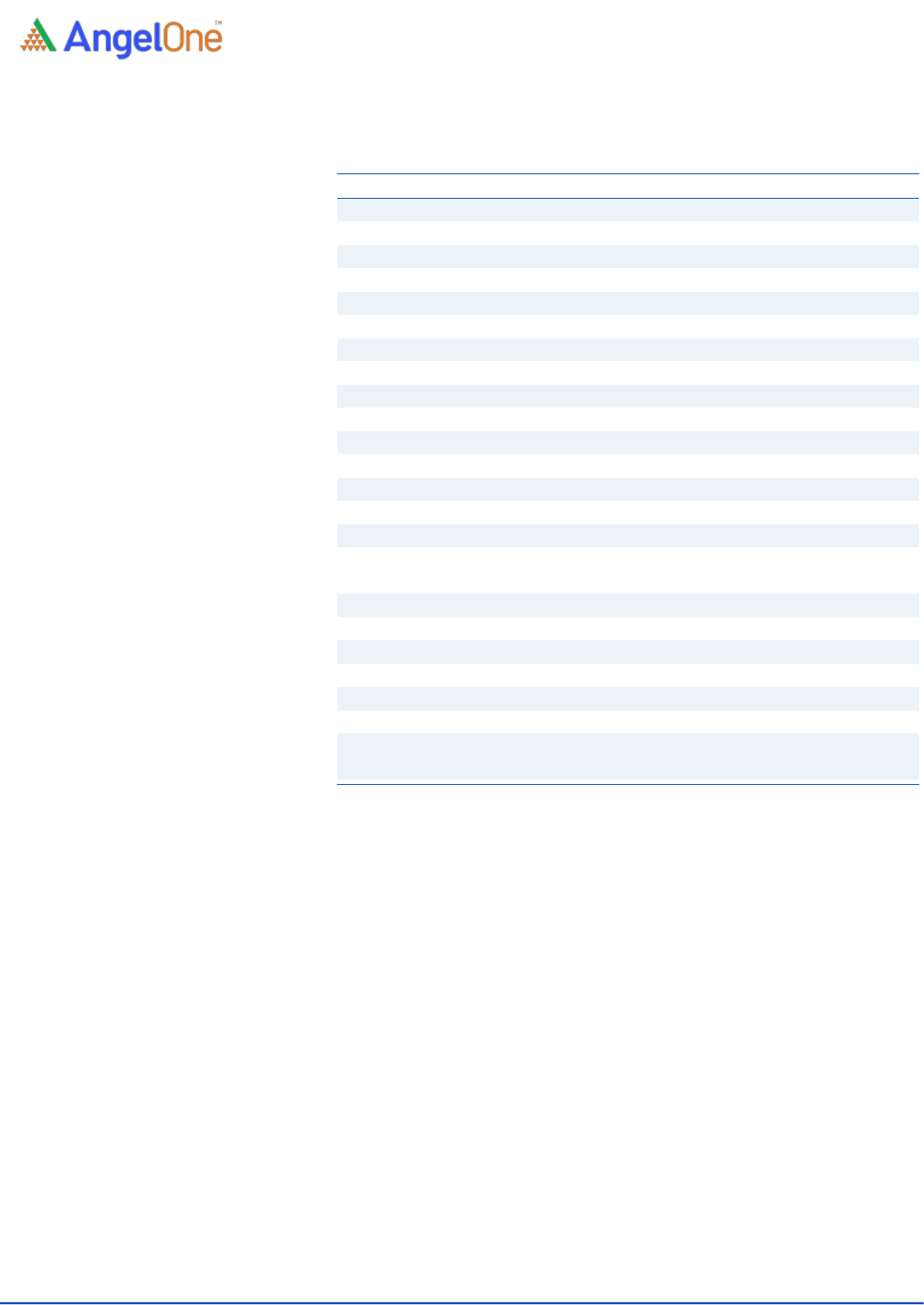

Financial Summary

Income Statement (Consolidated)

Y/E March (₹ cr)

FY’21

FY’22

Net Sales

438

1,020

% chg

133%

Total Expenditure

392

925

Raw Material

282

719

Personnel

29

60

Other Expenses

81

147

EBITDA

47

94

% chg

102%

(% of Net Sales)

10.7

9.3

Depreciation& Amortisation

12

19

EBIT

35

75

% chg

116%

(% of Net Sales)

7.9

7.4

Interest & other Charges

5

7

Other Income

6

13

(% of PBT)

17.0

15.7

PBT

36

81

% chg

123%

Tax

8

27

(% of PBT)

21.2

33.1

Share in profit of Joint venture

3

3

PAT

32

57

% chg

77%

(% of Net Sales)

7.3

5.6

Basic EPS (Rs)

2.8

5.0

Source: Company, Angel Research

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

6

Balance Sheet (Consolidated)

Y/E March (₹ cr)

FY’21

FY’22

Equity Share Capital

1

138

Reserves& Surplus

241

434

Shareholders’ Funds

242

572

Minority Interest

-

11

Total Loans

61

218

Other Liabilities

4

10

Total Liabilities

307

811

APPLICATION OF FUNDS

Net Block

81

261

Goodwill

-

118

Capital Work-in-Progress

0

39

Investments

92

41

Current Assets

265

665

Inventories

77

291

Sundry Debtors

128

272

Cash

30

37

Loans & Advances

-

-

Other Assets

30

65

Current liabilities

156

330

Net Current Assets

108

335

Deferred Tax Liabilities (net)

(1)

9

Other Assets

24

26

Total Assets

307

811

Source: Company, Angel Research

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

7

Cashflow Statement (Consolidated)

Y/E March (₹ cr)

FY’21

FY’22

Profit before tax

36

81

Depreciation

12

19

Change in Working Capital

-16

-66

Interest / Dividend (Net)

4

5

Direct taxes paid

-10

-23

Others

-2

-1

Cash Flow from Operations

24

15

(Inc.)/ Dec. in Fixed Assets

-6

-79

(Inc.)/ Dec. in Investments

-89

-311

Interest Received

0

-3

Cash Flow from Investing

-94

-394

Proceeds from issue of Equity Shares

33

272

Issue of Preferrential Shares

70

0

Inc./(Dec.) in loans

-31

91

Dividend Paid (Incl. Tax)

0

0

Interest / Dividend (Net)

-5

-4

Cash Flow from Financing

68

358

Inc./(Dec.) in Cash

-3

-20

Opening Cash balances

31

3

Closing Cash balances

28

241

Source: Company, Angel Research

Key Ratios

Y/E March (₹ cr)

FY'21

FY'22

Valuation Ratio (x)

P/E (on FDEPS)

78.3

44.2

P/CEPS

56.8

32.9

P/BV

10.4

4.3

EV/Sales

5.6

2.6

Per Share Data (Rs)

EPS (Basic)

2.8

5.0

EPS (fully diluted)

2.8

5.0

Cash EPS

3.9

6.7

Book Value

21.2

51.2

Returns (%)

ROE

11.8

9.5

ROCE

11.4

9.5

Source: Company, Angel Research;

Syrma SGS Technology Ltd | IPO Note

August 10, 2022

8

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity

with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred

to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of

such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject

company. Research analyst has not served as an officer, director or employee of the subject company.